Winning Plan

What is Winning Plan?

Financial planning as a broader term is maintaining your finances. But when you break it down to a microlevel, it is a step-by-step approach of knowing, growing, accumulating, and managing your wealth or funds.

Why do we need to make a Winning Plan?

Money always remains as one of our necessities for survival. Every one of us works towards earning money and most of us are successful in doing that. But the most crucial part is to save and grow this money and this is where few of us fail.

Hence a winning plan can help us to have a clear picture of your money earned, money spent and the money that can be saved and grown.

Benefits of Winning Plan and Management

- High possibility of Goal fulfillment

- Peaceful, stress-free, and secured post retirement life

- Balanced investments (high risk/ low risk, high returns/ low returns)

- Insurances in place

- Financial responsibilities towards family (children education, marriage) taken care of, hassle free

- Tax management giving opportunity to save more money

- Accumulate emergency fundImprove standard of living

Rules for making a Winning Plan

These are few of the thumb rules for making a winning plan that help you to make a good road map of your funds. These lay the foundation of a stress free winning plan customized to your needs and taste.

- Identify your sources of finance

- Identify your goals and prioritize them into short term, mid-term, long term

- Identify your needs and wants

- Categorize expenses to Fixed/Variable, Urgent/Non Urgent, Necessity/Luxury

- Follow the 50:30:20 rule- 50% of the income goes to needs, 30% for wants and 20% to savings and investments

- Up to 4% of saving should go to Fixed Income generating instrument like FD, CD

- Manage debt smartly, 1st pay off the most expensive debt

- Pay taxes on time

- Cover all your risks

- Save funds for emergencies

- Plan and save fund for your retirement

- A retirement corpus target which should be about 20 times of one’s annual income

- Have insurance for all your assets

- Always have life insurance with a sum assured of 10 times your income

- Always diversify your funds in different options

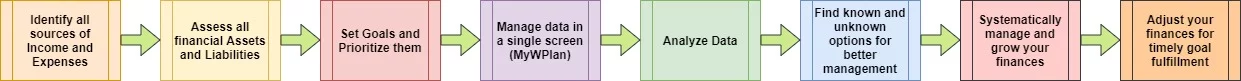

Steps to Make a Good Winning Plan

Our investors

Weu2019re lucky to be joined on this journey by some of the

u00a0best investors in the game.

u00a0best investors in the game.

Work with us

Now let's grow yours!

Lorem ipsum dolor sit amet, consectetur adipiscing elit